Tax prep and filing with LZ Tax

Background

LZ Tax lets small business owners prep and file their taxes with the help of a dedicated tax expert.

How it works: Customers answer questions about themselves, their income, and their business. Based on their answers, they upload supporting documents. The customer’s tax expert takes over to review info for accuracy, find as many credits and deductions as possible, and then files the tax return on the customer’s behalf.

My role

Lead content design and storytelling for a total redesign of the tax prep and filing experience…

All while introducing and establishing content design as a discipline at LegalZoom as 1 of 2 founding content design hires!

Challenges

Customers have no idea what they’re doing (understandable)

Most customers are first-time business owners, and taxes are hard. Customers generally try to do things the right way, but for some reason or another, they aren’t succeeding. They don’t know anything about accounting and learn things last minute, which sometimes ends up not being the right thing at all.

Customers don’t understand what they’re paying for (really bad)

New customers expect their tax expert to do everything for them; all they need to do is give their expert a shoe box of receipts. They get frustrated when they find out this isn’t the case.

At the same time, they don’t realize there are routine activities they should be doing to run a healthy business, like tracking income and expenses. They also don’t realize that if they have this basic info up to date come tax time, their tax expert can get their taxes done more quickly, with better financial results.

Approach

LZ Tax welcome

1: Set ground rules, but be chill about it

Taxes are scary for first-time business owners, always. To minimize anxieties, I clearly establish what we expect from customers and what they can expect from us, right from the start. I also craft language that not only reassures, but also meaningfully informs. For example:

“Your dedicated tax expert” communicates customers will have a single and consistent point of contact (who is a real human person).

“We’ll email you along the way” communicates we’ll proactively notify customers, so they don’t miss any deadlines and won’t need to juggle all the small details themselves.

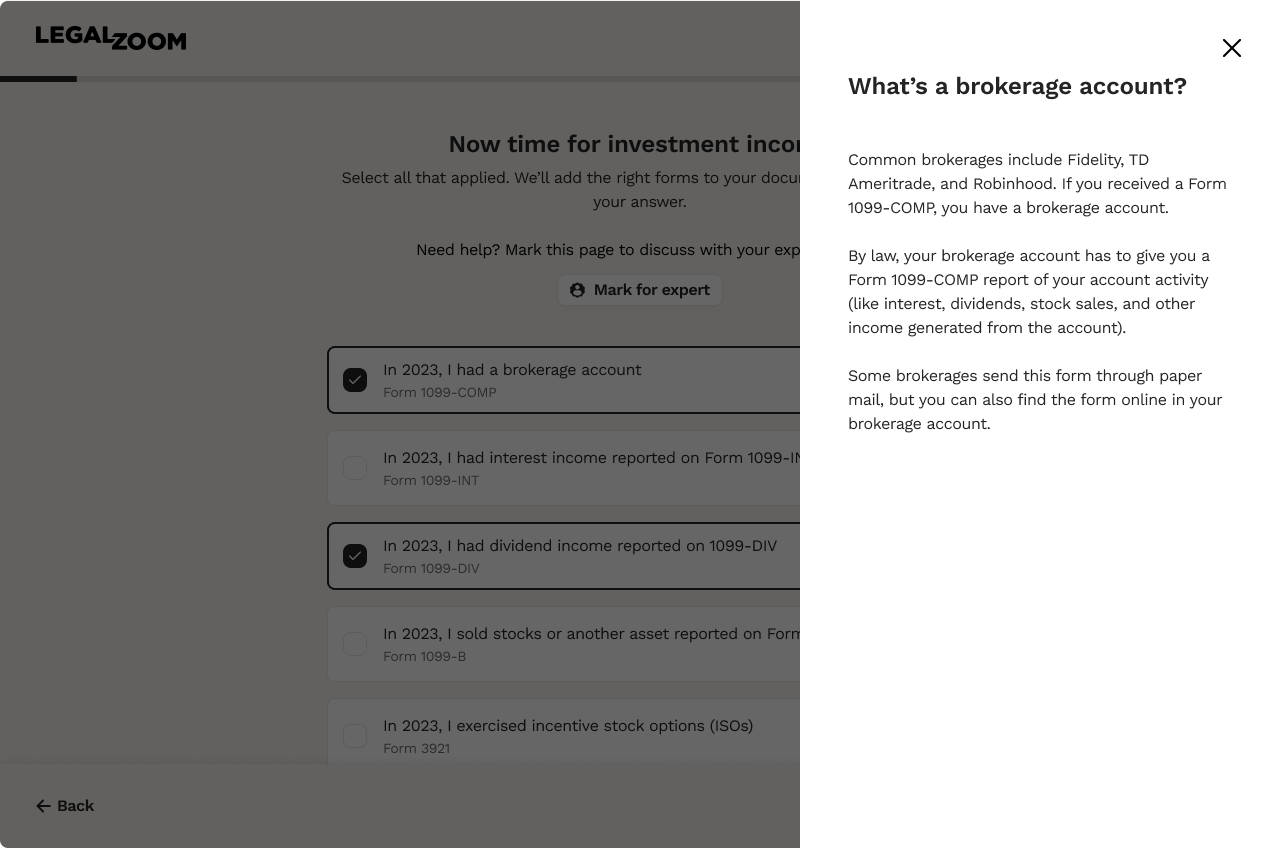

Multiple access points for help

Drilled down help content

2: Provide multiple layers of help, all within reach

Customers can get help multiple ways when answering tax questions, with some ways being more immediate than others.

“Mark for expert” lets customers know they can flag hard questions to discuss with their expert later, encouraging progress.

Subtext with the associated tax form for each answer choice helps customers identify if an option applies to them. For example: Let’s say a person doesn’t know what a brokerage account is, but knows they received a Form 1099-COMP. They can confidently select the first checkbox and proceed.

Info icons for each checkbox help customers better understand their tax situation, without needing to search on their own. This help content not only explains the concept, but also proactively helps customers determine if the option applies to them in simple terms.

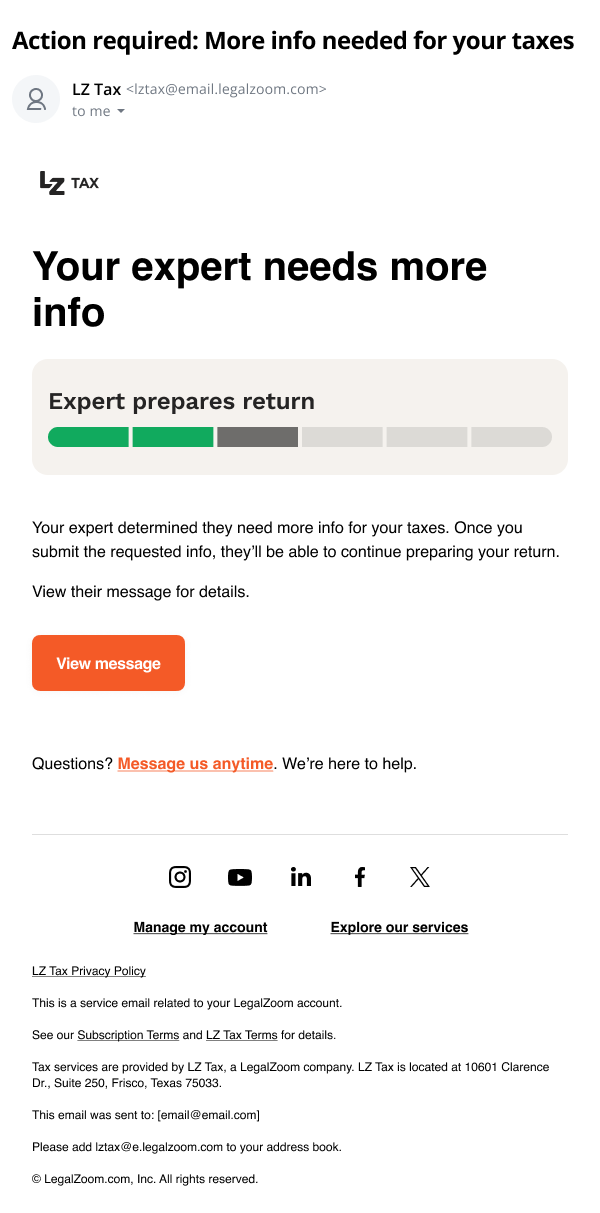

Bring customers back from drop-off

3: Deal with the fact drop-off is a feature, not a bug

Drop-off is built into the LZ Tax experience by design. Once customers finish providing their info, there’s nothing for them to do for a few days while their tax expert reviews and prepares their return. This lag makes effective transactional emails critical to the experience and ensures customers stick with us until the very end.

In this example, the customer gets news they need to provide more info for their taxes.

Tax expert requests more info

4: Avoid blame games when things don’t go to plan

Customers may be asked to provide more info for various reasons:

They made a mistake

Their tax expert made a mistake

No one made a mistake, but there’s an opportunity for more tax benefits (which requires more info)

To accommodate all these scenarios with a single message, I leaned on a matter-of-fact approach. Simply: We have a better understanding of your situation as it has developed, and we just need some info to get things moving along and get you the best outcome.

Result

A clear and sympathetic tax experience that saves time and protects from liability, for both customers and LegalZoom.

With clear language, I was able to save both customers and LegalZoom time and money (and 💔 heartache 💔).

For customers, making tax questions and instructions easy to understand helped them answer questions more quickly and accurately. This accuracy, in turn, helped tax experts speed up their own work and reduced calls to customer support.

By distilling complex tax ideas and outcomes with sensitivity (and always accounting for the worst “what ifs”), I was able to protect customers and LegalZoom from liability, like penalties and interest fees from underpaid taxes.

Success metrics can be shared in a private presentation.